Why Are Natural Diamonds So Expensive? | Rare Carat

A simple Google search into the topic yields article after article that all seem to regurgitate the same content again and again. It seems like everyone is on the same train that DeBeers' marketing and monopoly is the sole reason to blame. But how is that true? Another Google search also clearly shows that DeBeers and their mines are not the only sources today. So what is going on?

Let's Follow the Money:

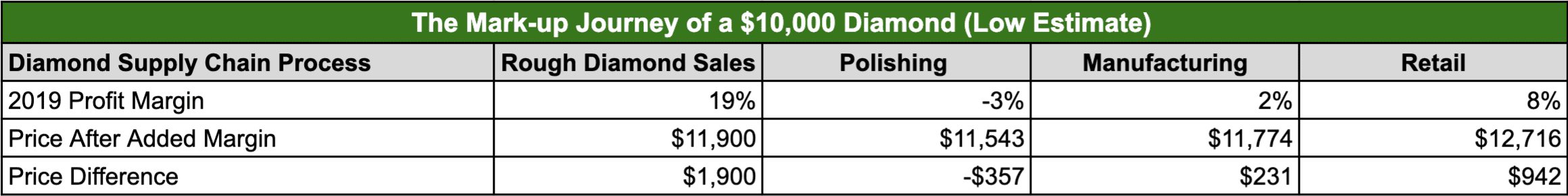

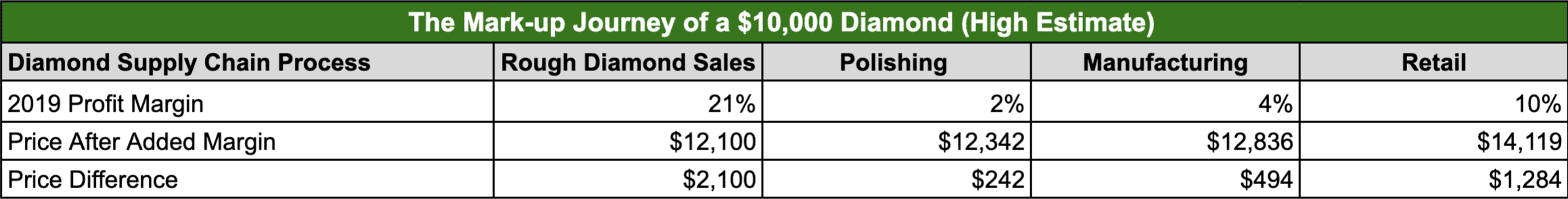

According to a report from Bain & Company, the overall profit margin for the industry in 2019 looks like this. The mining sector has the highest average profit margin at 19-21%. The process of polishing and cutting the diamond creates a margin of -3-2%. To turn the polished diamond into jewelry, manufacturing takes in a margin of 2-4%. Finally, the retail market marks up the diamond at 8-10%.

It may not be the most scientific nor the most accurate method, but we can run a little experiment on how the price of a diamond changes as it goes through the stages of the diamond supply chain. If you run the numbers, a ten thousand dollar diamond will end up with a final price of $12,716 - $14,119 and a total margin between 27% - 41% added. As you can see the process of getting a diamond from the mine to the consumer is a long process and involves many players who all want to turn a profit. What really drives up the prices of diamonds exists mainly in two areas: mining and retail.

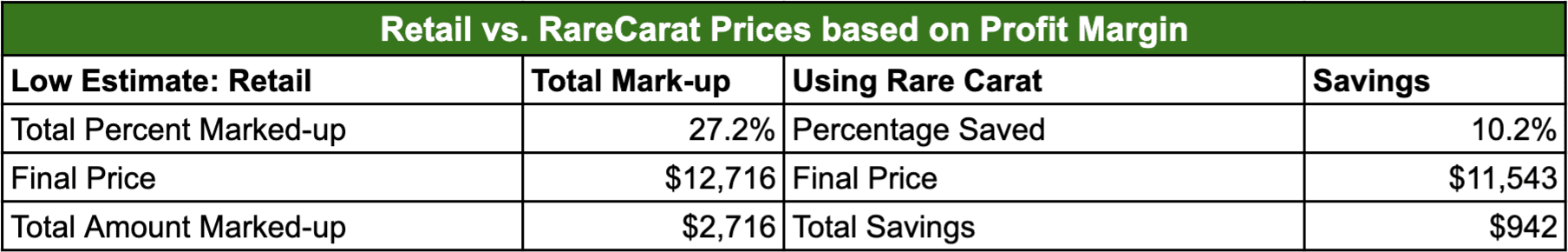

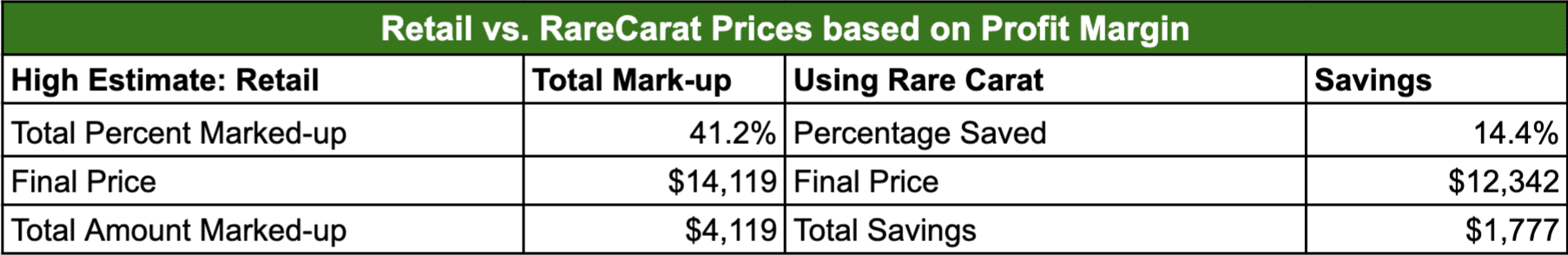

If you use a website like Rare Carat, you are buying the diamond before the manufacturing and the retail process, buying the diamonds at $11,543 - $12,342. This means that you are saving around $942 - $1777, or saving around 10.2-14.4% on the diamond if you were to buy on the retail level. But a diamond that is worth $10,000 is still priced at 15.43 - 23.42% above the value before the average profit margin.

So let’s start with the elephant in the room: mining

Mining: an Extremely Expensive Gamble

Is the DeBeers Cartel Real?

Many sources claim that the hefty price tag on the stone is purely the creation of DeBeer's market manipulation and all that the consumers are paying is just an artificially restricted supply.

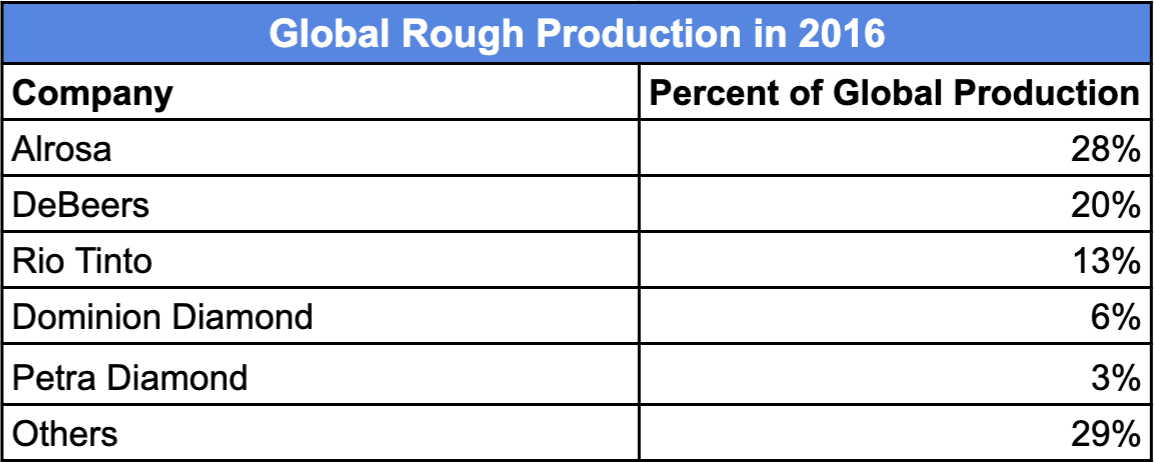

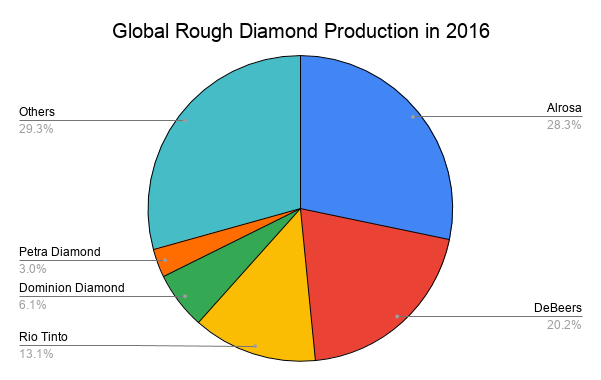

Well, let's look at numbers on the matter then. A chart based on the Kimberley Process from 2016 shows that Alrosa, a Russian diamond mining company, produces 26% of the global rough diamond supply. DeBeers in comparison produced only 20%. Surprise, it's not DeBeers anymore.

According to the Kimberly process in 2019, Alrosa accounts for 32.8% of rough by weight and 30.3% by value. Yet again the Russians have beaten DeBeers at their own game and are getting better year on year.

According to the Kimberly process in 2019, Alrosa accounts for 32.8% of rough by weight and 30.3% by value. Yet again the Russians have beaten DeBeers at their own game and are getting better year on year.

Is a Diamond Rare?

Many have heard the argument that diamond, a form of carbon crystal, is the same chemical substance as pencil lead and thus worthless. Let's dive into the numbers then.

In 2019 the annual production of rough diamonds was 139 million carats. So let's compare to something we are more familiar with: gold. The annual production of gold is 3463.7 tonnes. In carat terms, that would be 17 billion and 300 million carats worth of gold. That makes the annual production of gold 124.6 times more than diamond.

If these values are anything to go by, I would wager that if you believe gold is rare then diamonds are probably rarer.

Diamond Mines are rare and definitely expensive:

According to a report by Bain & Company, there have been around 10,000 kimberlite tubes that have been explored in the world. Only around 100 have been proven to be economically reliable to mine. This makes only around 1% of the kimberlite tubes viable deposits. Annual diamond exploration costs are around 320 million dollars a year and only 1% of the mines that people find would have the potential to pay off. Great you have spent millions of dollars and found a diamond mine worth your money and time. Now the process of setting up the mine is going to take on average 7.8 years and another hundred of million dollars to get your mine started and your first diamond out of the ground. Mining diamonds entail huge risks and financial investment over a long period of time.

Operating Cost:

After all, that ordeal of finding and setting up a diamond mine, let's see how much it takes to operate a mine.

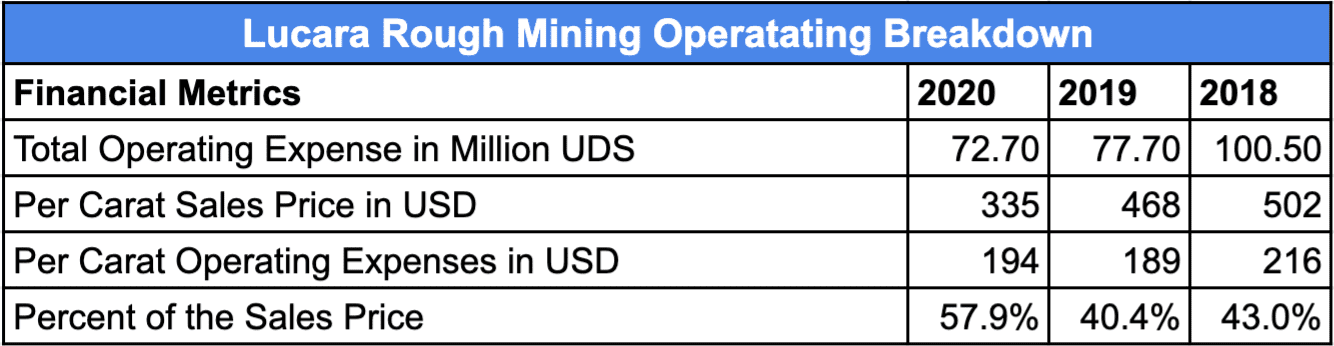

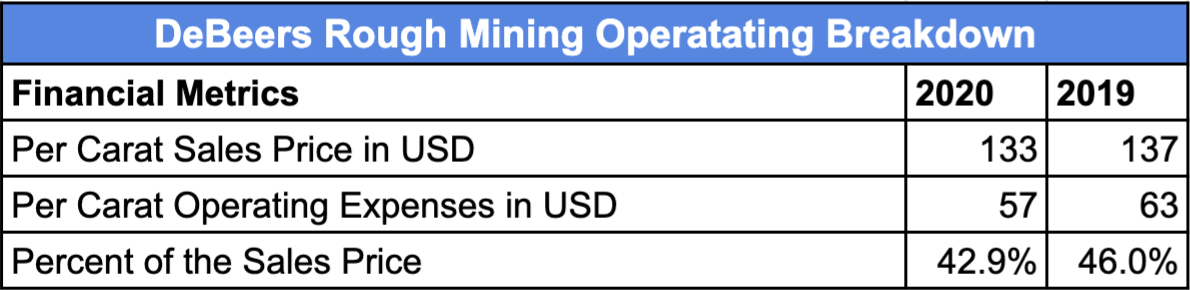

Let's take a look at Lucara, a Canadian mining company operating in Botswana. Lucara has been known for innovative diamond recovery technology and represents one of the most efficient diamond mines operating today. This will be an optimistic overestimate of how much it costs to mine diamonds. From the chart below you can see that on average about 50% of the final rough price comes from operating expenses. So at least half of the rough price is mining cost. This is consistent with figures provided by DeBeers with its unit cost for 2020 around 42.8% and 2019 around 45.9% of the final sales price.

Not all diamonds are made equal:

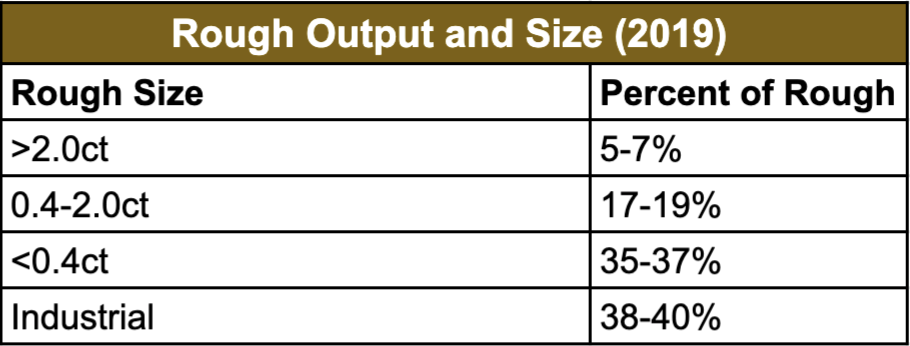

From a typical mine, only 5% of the rough is larger than 2cts. 45% are between 0.1-2.0 ct. The remaining 50% are less than 0.1ct. So anything that is going to end up as your engagement stone likely originated from the 5% of roughs that came out of the mine. But some might argue that most engagement rings are not around 2 carats. Yes, but don't forget that you have to cut and polish the stone. The most popular shape of round loses on average 50% or more of the rough weight after cutting. So, any stone that will end up as the main stone on your ring will likely be from that 5%.

As you can see the myth of DeBeer effortlessly pulling some worthless rock out of the ground and selling it for billions is not accurate. It's no longer just DeBeers, nor is the process effortless and cheap. The production of diamonds by definition is a time and resource-intensive process.

Demand: The Final Push

But what about demand in all of this? While it is notoriously hard to track, we can use the retail profit margin as a gauge. Compared to all the processes in the diamond's journey from mine to consumer, we can see that after mining the highest margins exist in retail at almost half of that of mining. Now we can finally mention DeBeers and their vast influence on public perception. I don't think I don't need to say too much about how DeBeers single-handedly created the concept of the modern engagement ring, but the results are evident. People still strongly believe that a diamond ring does represent marriage. As long as we collectively buy into this notion, diamond prices are not going to be cheap and we can see the margin for retail is a big part of the final price of the diamond.

To summarize, a large majority of the price of a diamond comes from the mining and the retail of the diamonds. Because of the time-consuming extraction, investment-intensive beginning, and scarce nature of diamonds, the price to mine a diamond will always be a significant part of the price of diamonds. Retail also marks the diamond prices up significantly due to the enduring demand for diamonds as the staple for jewelry. Also, the long process and the many players on the path from a rough diamond to a finished ring further increase the final tag price.

Natural Diamond FAQs