Diamond Pricing

Apeksha leads business development. She has extensive experience in the diamond industry, including with Firestar/Nirav Modi. She is an MBA candidate at Harvard Business School, and earned her bachelor's degree from Oxford.

More importantly for this post, she is a third generation diamond trader.

It’s one of the questions I hear most often: How do you price a diamond?

The short answer: use rarecarat.com :)

The long answer:

Most of us diamond traders are quite old school. We weren’t trained with the massive datasets and computational power of Rare Carat – so we figure out what a diamond is worth through human intuition and haggling.

It’s kind of like buying car. You know the basics: the company, the model, and the year – and by looking up a few similar cars, you can get a ballpark figure of what it should be worth. But then you consider a bunch of other stuff. Like if it’s got low mileage? Great, you’d pay a little extra for that. But, wait it’s got a nasty scratch in back? Definitely insist on a discount for that. And ugh, is bubblegum pink really the shade you want? And you go back and forth until you get to a price you’re cool with.

Pricing diamonds are kind of like that.

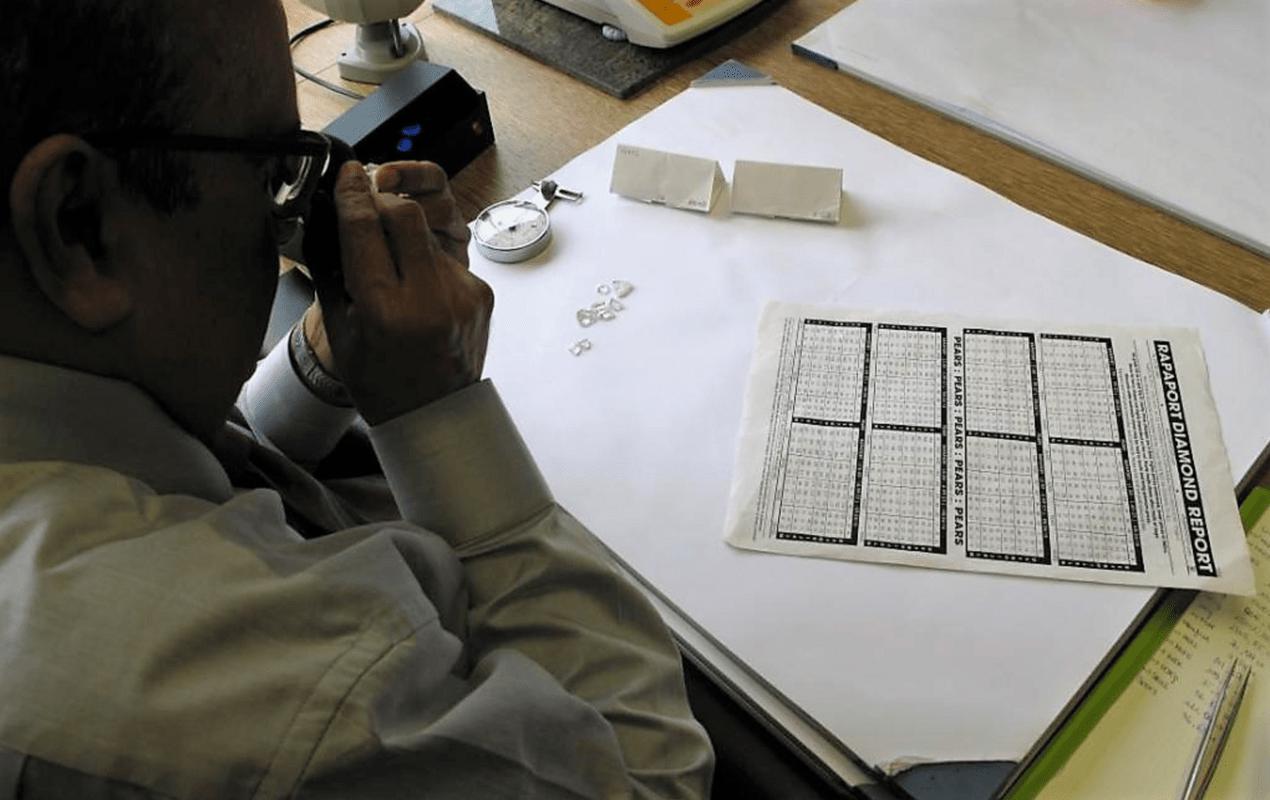

You start with the basics: size, color and clarity. And there’s a handy little diamond quality and price chart published by a publication called Rapaport that traders use to get a ballpark using these three criteria.

Here’s my dad in action with the Rapaport list. This was not at all staged for this blogpost. Nope.

Traders find the diamond’s size-color-clarity combination on these sheets and offer a discount or a premium on the price listed. For example, they could offer a 5% discount on a 1 carat-H-VS1 combination (In diamond world lingo, that would be ‘5 back from the rap’).

I could probably figure out most of the diamond’s price with this information - and there are some people who will try to tell you that’s all it takes. Don’t believe it.

There’s a bunch of other stuff that matters. There are no clear guidelines, but you can base it off experience and trade knowledge that floats around.

Cut Clarity and Fluorescence

1. Clarity: Look at the kind of inclusions in your diamond certificate’s clarity grade. For example, you could have a great SI1, with a white inclusion right at the bottom (hard to see with the naked eye), or you could have a fairly ugly SI1, which an ugly, black inclusion on the top (easier to see).

2. Fluorescence: the stronger the diamond fluorescence, the lower the price – you should probably take a few percent off the price for medium fluorescence, and a few more for heavy fluorescence

Here he is again - checking fluorescence with a UV light machine. If the diamonds show up blue under the UV light, they have blue fluorescence (like whitened teeth at a rave)

3. Cut: same principle, take a few percent off for every cut grade you downgrade.

Here at Rare Carat, we’re told we’re a cut above the others (that's me on the right) ;)

Diamond Proportions and Parameters

4. Then there’s table width, pavilion depth, crown angles and a bunch of numbers that basically just add up to how sparkly the stone is. Diamond certificates all have this information these data and proportions. And if you want to get into crunching the numbers, we break it down by shape for you.

But if you’re like me, and a lot of diamond traders out there, we honestly just look at the stone to see if we think it’s pretty or not. Simple as that. So if that’s what you want to do instead, that’s absolutely fine too.

5. And then there are some parameters that only really matter when they’re out of whack:

- Polish (Basically if you can see little nicks and scratches on the surface)

- Symmetry (Anything lower than “Good” means it’s no good)

- Culet Size (A very large culet can look like a hole in your diamond)

- Girdle Thickness (Just apply the ‘Goldilocks principle’: not too thick, not too thin. You want it just right) A simple rule? Avoid the word "very" in the girdle description

…And that’s how humans like my dad and I do it.

The cool part about letting Rare Carat take over? Our artificial intelligence basically figures out all these tiny little rules that traders use, and learns how to rate deals better and faster than I can (seriously, we’ve had tournaments in the office).